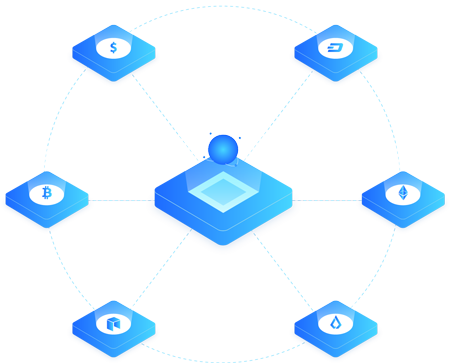

Technical work on the project commenced in the last quarter of 2017. Initial developments were carried out on EVM-based enterprise blockchain platforms. During these efforts, alternative blockchain platforms such as EVM-based Hyperledger, Quorum, Avalanche Subnet, and Polygon were explored. Following thorough research and analysis, developments were made incorporating certain academic and technical studies needed within the framework of privacy and auditability requirements, leading to the establishment of a customized EVM-based enterprise blockchain network infrastructure. This infrastructure has been named TAKASCHAIN, a term that combines the names Takasbank and Blockchain, reflecting a semantic unity. The TAKASCHAIN blockchain infrastructure is operated by Takasbank and its stakeholder institutions.

Istanbul Settlement ve Custody Bank Inc. Reşitpaşa Neighborhood, Borsa İstanbul Street, No:4 Sarıyer 34467 Istanbul

0 212 315 25 25 (pbx)

bilgi@takasbank.com.tr